In response to the risks and challenges posed by global climate change, the Company follows the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), integrates the four core disclosure areas of “Governance,” “Strategy,” “Risk Management,” and “Metrics and Targets” into the operation management. The Company discloses the implementation status and performance in its sustainability report, and expects that the stakeholders could understand the impacts of climate change related risks and opportunities on the Company, as well as the corresponding response measures.

Governance

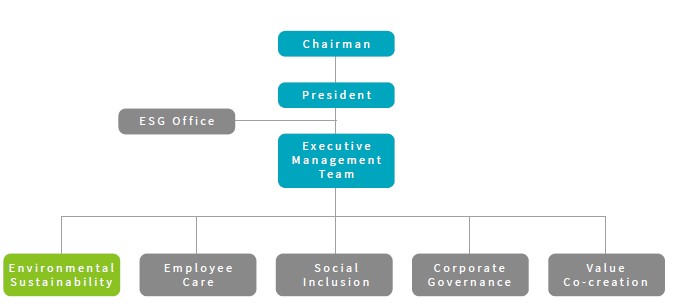

The Company has established a Sustainability Committee internally, with the Chairman serving as the Chairperson, the President as the Convener, and senior executives from each department serve as conveners of cross-departmental working groups, leading the committee representatives from their respective departments. Meanwhile, an ESG Office has been established as a dedicated promotion unit. Five functional groups are organized based on their roles. Among them, climate change-related topics are primarily promoted by the Environmental Sustainability Group. Departments such as General Affairs, Production, R&D, and Supply Chain have different implementation tasks. The ESG Office conducts environmental evaluation on the Company’s activities, products, and services, and conducts evaluation and management of risks and opportunities related to climate change. The ESG Office reports quarterly to the Board of Directors on overall sustainability actions and measures, so that the Board can effectively monitor the Company’s climate risk management and implementation. The Board may also propose improvement or implementation suggestions at any time to guide and oversee the Company’s climate risk management efforts.

Strategy

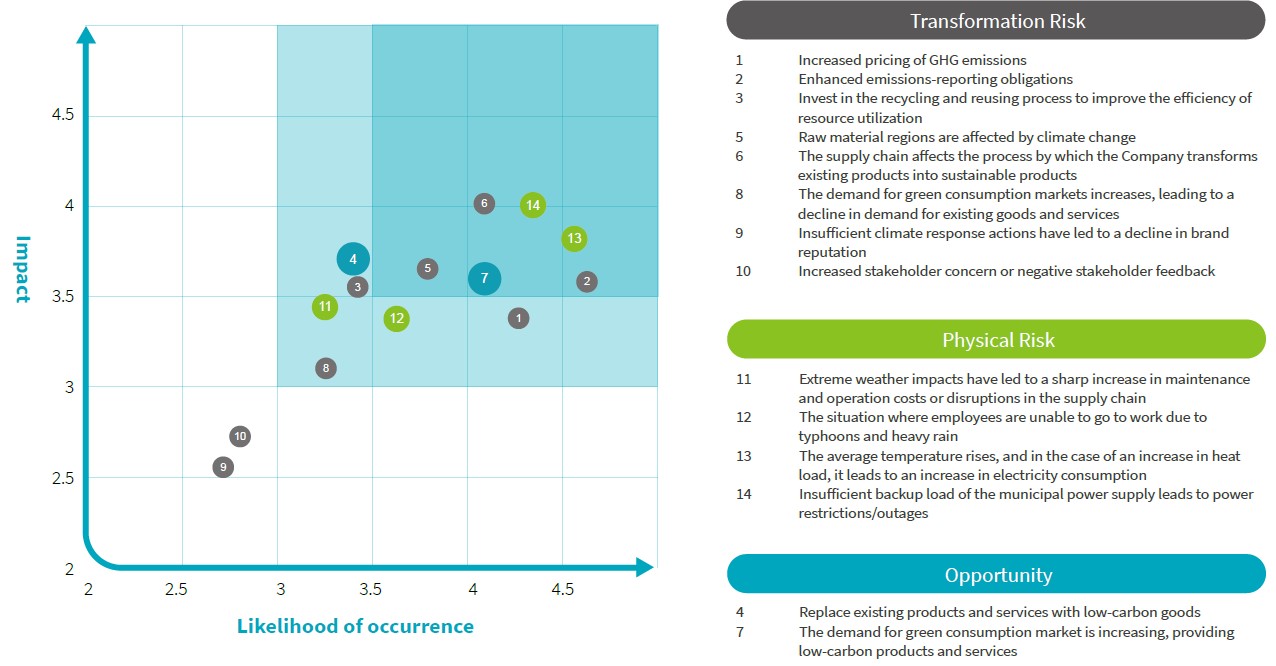

Faced with the potential operational impacts of global climate change and extreme weather events on the Company, the Company follows the framework outlined in the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, and begins to collect data, identify and evaluate the risks and opportunities associated with climate change and their potential operational and financial impacts on the Company. The Company has defined short-term as 1–3 years, medium-term as 3–5 years, and long-term as over 5 years, and has also planned various actions to address the risks and opportunities brought about by climate change.

Climate-related risk identification matrix

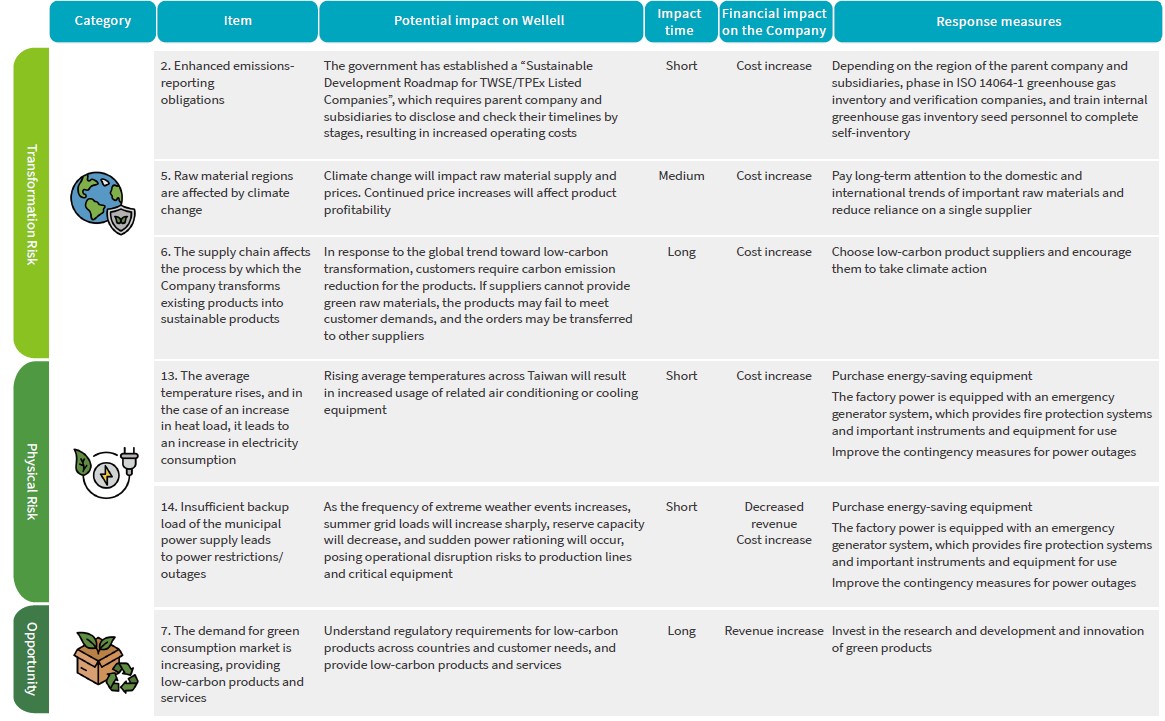

According to the reports and discussions of the Sustainability Committee and senior management, five climate-related risks and one climate-related opportunity were identified, with the following response measures proposed:

Risk Management

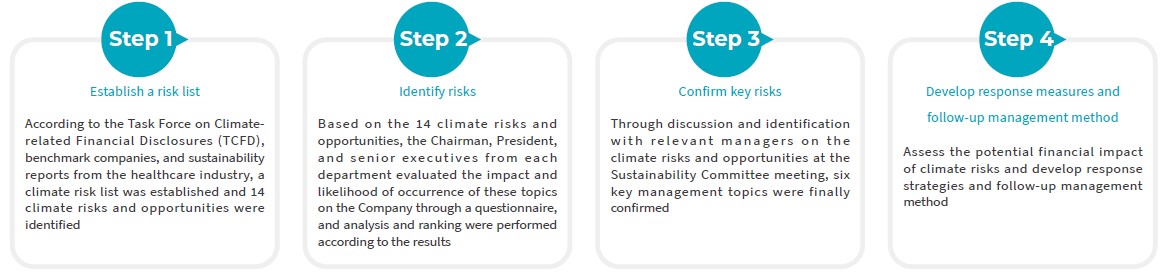

Wellell identifies climate risks following the TCFD framework, and the ESG Office refers to the Task Force on Climate-related Financial Disclosures (TCFD), benchmark enterprises, and sustainability reports from the healthcare industry to collect topics, and has summarized 14 climate risks and opportunities. A questionnaire is sent to the Chairman, President, and senior executives of various departments to evaluate the likelihood and impact of climate risk issues. The results are analyzed and ranked, and finally a sustainability committee meeting is convened to discuss and identify climate risks and opportunities with relevant members, and corresponding measures are formulated. Meanwhile, the identification results are included in the sustainability report, and a report is submitted to the Board of Directors at least once a year.

Climate Risk Management Process